Here We Go(ld) Again

With gold hitting yet another historic high, Kelsey shares some candid thoughts on the various strategies jewelry brands use — and what Abel might do — in the face of rising material costs.

If you know me personally, I’ve probably talked to you about gold prices in the past year (and you’re probably sick of hearing about them — sorry!).

When I first started working with gold in 2017, it cost about $1250/oz. I remember balking at the price of the two inches of wire I purchased to make my first gold ring — now I look back on those prices and wish I had bought the whole spool.

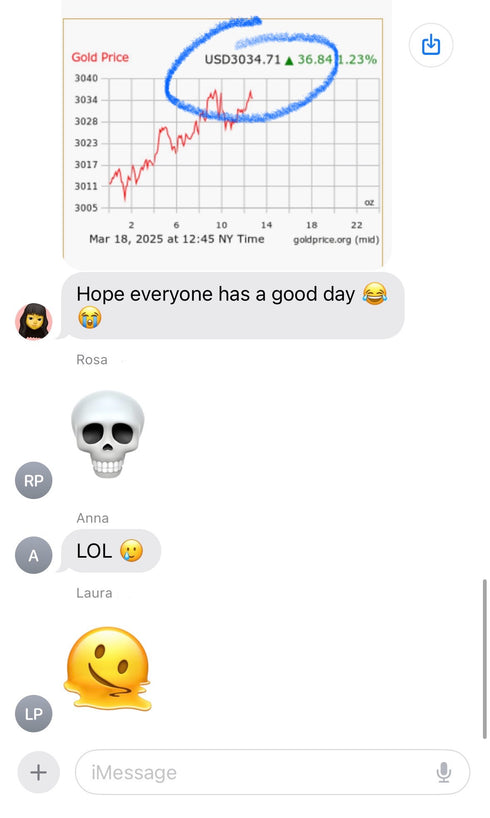

This past week, gold hit yet another historic high of $3000/oz. I repriced my entire collection less than a year ago in July 2024 when gold hit a then unprecedented $2450/oz, thinking (optimistically? naively?) I would be set for at least another year or two. Obviously, the world had other plans, and the price of gold is anticipated to only continue to increase.

So, what’s a jeweler to do?

A lot of people have been asking what my plan is — will I start offering plated gold pieces or daintier (and thus less expensive) styles? Will I increase my prices on a regular basis? The honest answer is I don’t know, and I am figuring all of this out in real time. There are some things I feel sure of, others less so (I’ll get into this after the jump), but I figured either way it can’t hurt to clue you into where my head’s at and include you in the dialogue.

Without further ado, here are some of my unfiltered thoughts and reactions to the current gold situation.

PLATED/FILLED VS. SOLID GOLD

As much as I wish I could offer the same prices as gold-plated jewelry, I will never plate or fill my pieces (and I am not someone who uses the word “never” casually). As a quick overview for those less familiar, here is a quick breakdown of the different types of gold jewelry:

GOLD PLATED

Gold plating uses a thin layer of gold (<0.5 microns) over a base metal like brass or stainless steel. This makes the price point affordable, however, over time the plating wears off.

GOLD FILLED

Gold-filled jewelry bonds a thicker gold layer (at least 5% of total weight) to a base metal, offering better durability than plating. While longer-lasting, it still wears down over time and lacks the permanence of solid gold.

GOLD VERMEIL

You may have seen jewelry listed as vermeil. These pieces use sterling silver as a base and must have a gold layer of at least 2.5 microns. While it is more durable than standard plating and hypoallergenic, the gold coating still eventually fades, requiring re-plating to maintain its appearance.

SOLID GOLD

The only type of gold jewelry I make, and hopefully self-explanatory. Jewelry made of solid gold alloy retains its value, lasts forever, and is the most durable and reliable choice for long-term investment.

There are many reasons why I remain steadfast in my commitment to making solid gold and silver jewelry. For one, plating and filling processes both require a significant amount of energy (and in the case of plating, the use of toxic chemicals such as cyanide-based solutions and heavy metals). They are designed such that they need to be periodically re-plated at best, discarded at worst.

Solid metals, on the other hand, retain their value indefinitely and can be recycled without degradation, making them the most sustainable choice. All of Abel’s pieces are made using 100% post-consumer recycled gold and silver, which means no newly-mined metals are introduced into the supply chain, further reducing its environmental impact.

The obvious downside of being committed to only working with solid metal is the price point — fine jewelry carries the highest price tag of the aforementioned types. When material costs push the price up even further, of course the initial instinct is to figure out how to cut them. My optimistic hope, however, is that the dialogue around precious metals as investments will actually serve to educate consumers and encourage them to consider their purchases more deliberately.

DESIGN STRATEGIES

There are other strategies jewelers can use to navigate the increased cost of materials: creating daintier (and thus lighter and less expensive) styles, hollowing out pieces (such as the underside of a ring), or exploring other metals. There are probably more I’m not thinking of here, so please shout in the comments if you have other ideas — I’m taking any and all suggestions right now lol. These various approaches fall into more of a grey zone for me, personally:

SHED SOME LBS (OR DWTS, RATHER)

Sorry, that title is a dumb joke only other jeweler’s will get. Moving on...

Gold is priced by weight, which means jewelry that weighs less and has less gold content is generally less expensive (and not as prone to dramatic price fluctuations within a changing market). Does this mean I’m going to start making daintier pieces? Yes and no.

Offering a variety of styles, including lighter and heavier designs, is honestly just savvy, and is something I’m trying to be mindful of as I expand my collection. Not only is it smart to offer a variety of price points to customers, but it’s also simply nice to give people options. So while I’m not going to change up my entire aesthetic or decide not to create something just because it’s chunky, weight will always be a consideration in the design of a piece — it will just never be the primary consideration.

HOLLOWING OUT PIECES

A common tactic jewelers use to reduce the cost of a piece of jewelry is to hollow out a less visible part, such as the backside of a ring. There are other reasons to reduce material usage, of course — I carved out the Arp Earrings as much as possible because I don’t like when earrings are too heavy (the cost savings were a cherry on top).

I’ve seen a lot of debate on this topic over the last year, and ultimately my take is that there’s not necessarily a right or wrong approach to hollowing out jewelry — I think it depends on the piece and what the priorities of the jeweler and consumer are. Both my personal preference and approach as a designer is to keep all of my rings solid in the back*, but someone else might prioritize a lower price point.

While I don’t necessarily look down on designers who offer hollowed out pieces, something I do feel strongly is that brands need to be transparent with consumers about the product they are selling. It’s misleading, perhaps even unethical, to present a product as solid when it’s actually hollow, and is an important factor the customer must be able to weigh (no pun intended, I swear!) when considering a purchase.

*An exception is some custom rings I’ve made that feature diamonds, in which case a hollow back allows light to pass through the stone.

EMBRACING OTHER METALS

It’s predicted that silver-toned metals will rise in popularity in the wake of rising gold costs. While technically I sold slightly more gold than silver pieces both in 2023 and 2024, anecdotally I’ve definitely noticed an uptick in people being interested in mixing their metals. Last year, multiple people purchased a pair of Column Stack Rings — one ring in gold, the other in silver.

Personally I’ve always worn both gold and silver-toned jewelry, and at least for now I feel committed to continuing to offer most of my styles in both sterling silver and 14k yellow gold. Not only do I appreciate the more accessible price point of silver, but I also simply like (and sometimes prefer) the look of silver for some styles.

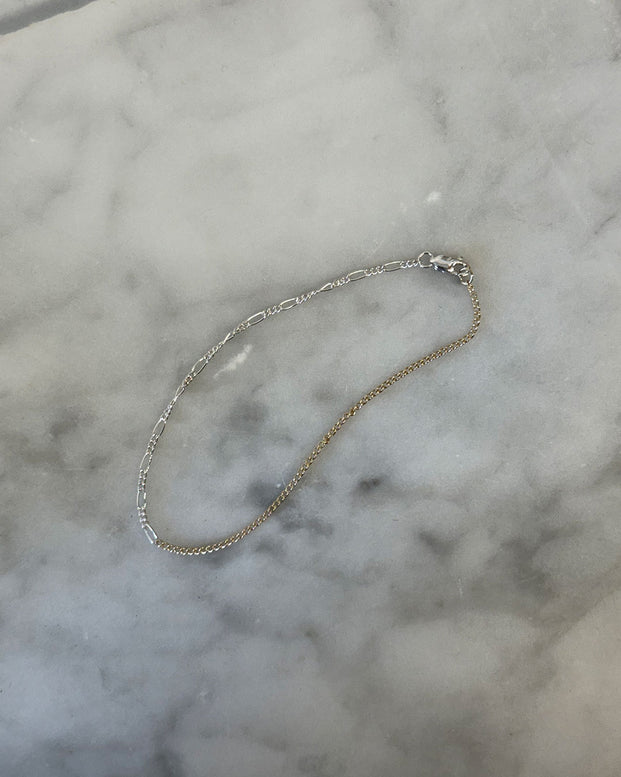

I’m also always open to making my existing styles in other metals. I recently made a Facet Ring in 10k gold, which brought the price down since the gold content of that alloy is lower than 14k. I’m also interested in exploring mixed metal styles, such as this mixed metal Epps I Bracelet I made for a client after they asked if it was possible. By using silver for the more expensive bracelet components, I was able to make the piece for $280 (for reference, the fully gold version is $448).

Another piece I’m interested in making a mixed metal version of is the Column Stack Ring… are any of these “pre-mixed metal” pieces something you’d be interested in?

RAISING PRICES

Ugh — my least favorite part of all this, and one of the most common topics in the jewelry group chat. When to reprice? How to reprice? When do I tell my stockists? Should I give my customers a heads up or just not say anything?

The question of whether or not repricing will have to become a regular practice for jewelers looms large, at least over myself and the peers I’ve spoken to in the industry. Not only is it an enormous amount of work to reprice an entire catalog, but it’s also a brutal process emotionally (if you’ve ever had to put a price on something you’ve created, you get it)

The fact that gold has already increased ~$600/oz in the nine months since I repriced is disheartening to say the least (though I’m happy for anyone who bought anything from me ahead of the price increase… you made a good investment! #finance). As with most things in life that lie outside of my control, my strategy is to simply focus on what I can do — staying informed but calm, and making moves only when it makes sense.

In practical terms this means continuing to monitor the gold price and my product margins, and if a reprice is needed, so be it. Last summer I gave my customers a couple weeks heads up before the price increase took place, and I believe that’s the approach I’ll stick to in the case of a future sitewide increase. And obviously this is a topic I’ll continue to yap about, so don’t worry — you certainly won’t be caught off guard so long as you keep reading these ramblings of mine.

Okay, that’s enough from me — I want to hear from you now! Are rising gold prices affecting your own purchase behavior? What trends or strategies have you noticed stemming from increased material costs? Are you team gold or team silver? My ears and inboxes are always open.